In the competitive marketplace, print insurance marketing remains a tried-and-true strategy for communicating your benefits to potential policyholders.

Maximizing Open Enrollment Success: 6 Key Print Materials Every Insurer Needs

Maximizing Open Enrollment Success: 6 Key Print Materials Every Insurer Needs

Open enrollment is a crucial time for insurance companies to attract new members and retain existing ones. In the competitive marketplace, print insurance marketing remains a tried-and-true strategy for communicating your benefits and value to potential policyholders. In this blog, we’ll explore six essential insurance print materials to maximize open enrollment success and elevate member experience.

Direct Mail Open Enrollment:

Direct mail marketing remains a powerful tool for reaching new members and reminding existing ones during open enrollment. Postcards, mailers, letters, and advertisements come in all shapes and sizes and can be used to send personalized messages, promotions, renewals, and important information about insurance plans. Direct mail allows potential policyholders the time to review and research your offerings, directly or online. With Preferred Direct’s experience and technology in direct mail services, we’ll help you create eye-catching designs with a strong call to action and targeted audience to increase your campaign ROI.

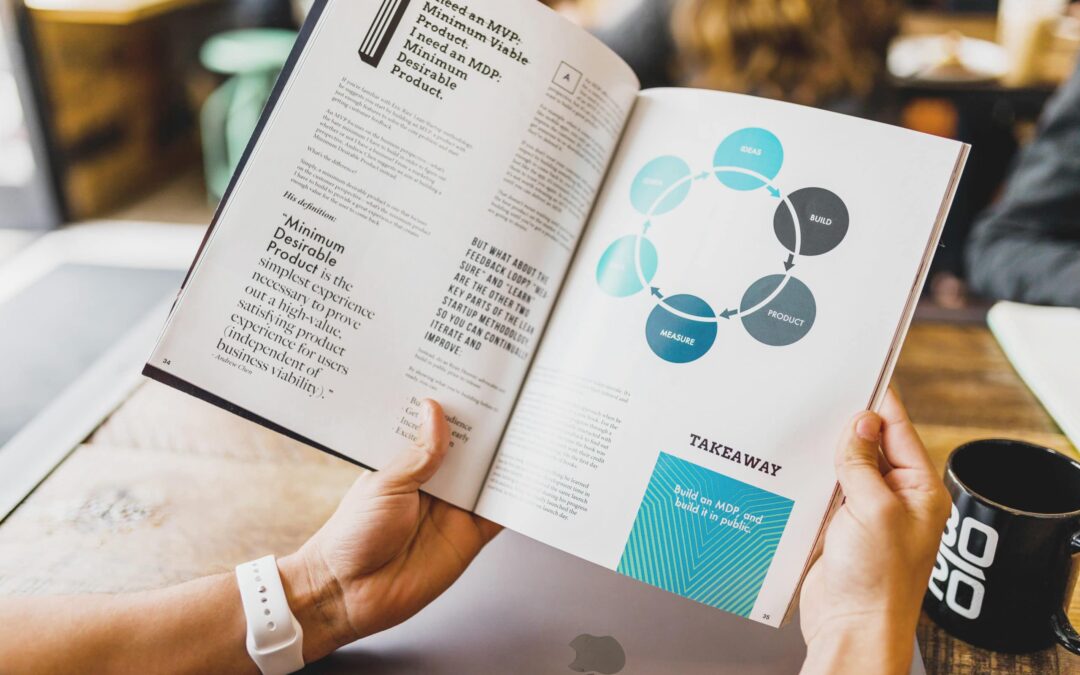

Printed Newsletters:

Creating a printed newsletter, with professional finishing such as saddle stitch binding, will certainly leave an impression. This print insurance marketing approach not only caters to a diverse demographic, including those who may prefer traditional communication methods but also makes it more likely to be noticed and retained. Including member benefit summaries, featured doctor and hospital news, and even a nutritional cooking recipe, can help create an engaging newsletter that establishes a tangible connection with your audience, encouraging policy enrollment and retention.

Creating a printed newsletter, with professional finishing such as saddle stitch binding, will certainly leave an impression. This print insurance marketing approach not only caters to a diverse demographic, including those who may prefer traditional communication methods but also makes it more likely to be noticed and retained. Including member benefit summaries, featured doctor and hospital news, and even a nutritional cooking recipe, can help create an engaging newsletter that establishes a tangible connection with your audience, encouraging policy enrollment and retention.

Third Party Billing:

Third-party billing can provide a seamless process for collecting premiums, deductibles, and communicating coverage details. These documents should be designed with the utmost clarity to ensure that policyholders can easily understand their financial responsibilities. Preferred Direct is a HIPAA-compliant and HITRUST-certified printer, excelling in high-quality third-party billing services. We take pride in making sure your customers have a smooth experience during open enrollment and billing because we know happy customers can equal lifetime policyholders.

Explanation of Benefits:

Explanation of Benefits (EOB) statements are essential for policyholders, providing a breakdown of the costs associated with their services. Just like third party billing, having a professional and concise EOB document and communication process will improve your member experience making them more likely to renew each year.

Member Handbooks:

Member handbooks are valuable tools for insurance companies seeking to provide their policyholders with comprehensive information about their coverage. These handbooks serve

as a go-to resource for policyholders, offering details on benefits, claims procedures, network providers, and other essential information. A well-structured member handbook can be a valuable asset for both policyholders and insurance companies during open enrollment, fostering trust and confidence in your services. With state-of-the-art printing and finishing technology, Preferred Direct can create a professionally printed and bound resource that strategically covers all your insurance offerings.

Document Printing:

During open enrollment, insurers have a multitude of documents to print, ranging from member forms, contracts, and more. Preferred Direct offers state-of-the-art document printing services that guarantee accuracy, consistency, and professionalism. Your insurance company can rely on us to produce high-quality insurance marketing print materials that reflect your commitment to providing excellent service.

Preferred Direct has over 35 years of experience as a second-generation family business working with insurance providers throughout the US. In our experience working with some of the largest insurance companies in the nation, to maximize success during open enrollment, it’s essential to invest in the right print materials. By incorporating third-party billing, direct mail marketing, advertising postcards, explanation of benefits, and document printing into your open enrollment strategy, you can create a comprehensive and compelling marketing campaign. These materials not only convey essential information but also reflect the professionalism and trustworthiness of your insurance company and its services.

Preferred Direct has over 35 years of experience as a second-generation family business working with insurance providers throughout the US. In our experience working with some of the largest insurance companies in the nation, to maximize success during open enrollment, it’s essential to invest in the right print materials. By incorporating third-party billing, direct mail marketing, advertising postcards, explanation of benefits, and document printing into your open enrollment strategy, you can create a comprehensive and compelling marketing campaign. These materials not only convey essential information but also reflect the professionalism and trustworthiness of your insurance company and its services.

For a successful open enrollment season, trust Preferred Direct as your full-service business communication partner. Contact us today to discuss our marketing and design services to help you goals this enrollment season.

Kickstart Your Accountant Marketing with Direct Mail

5 Pro Tips for Your Annual Company Newsletter

In the competitive marketplace, print insurance marketing remains a tried-and-true strategy for communicating your benefits to potential policyholders.

Maximizing Open Enrollment Success: 6 Key Print Materials Every Insurer Needs

In the competitive marketplace, print insurance marketing remains a tried-and-true strategy for communicating your benefits to potential policyholders.

Print-on-Demand: A Game-Changer for Economical Print

With the emergence of Print-on-Demand (POD) technology, customers now have a more economical and efficient solution for their mass printing needs.

EOB forms

EOB forms

While some patients choose to view their Explanation of Benefits online, many patients are reluctant to view sensitive information online and would prefer to receive a hard copy by mail.

While some patients choose to view their Explanation of Benefits online, many patients are reluctant to view sensitive information online and would prefer to receive a hard copy by mail. When you are dealing with Explanation of Benefits you must be certain that all HIPPA rules are met. Be especially careful with any and all information relative to the person, and that information should be treated with the utmost confidentiality.

When you are dealing with Explanation of Benefits you must be certain that all HIPPA rules are met. Be especially careful with any and all information relative to the person, and that information should be treated with the utmost confidentiality.